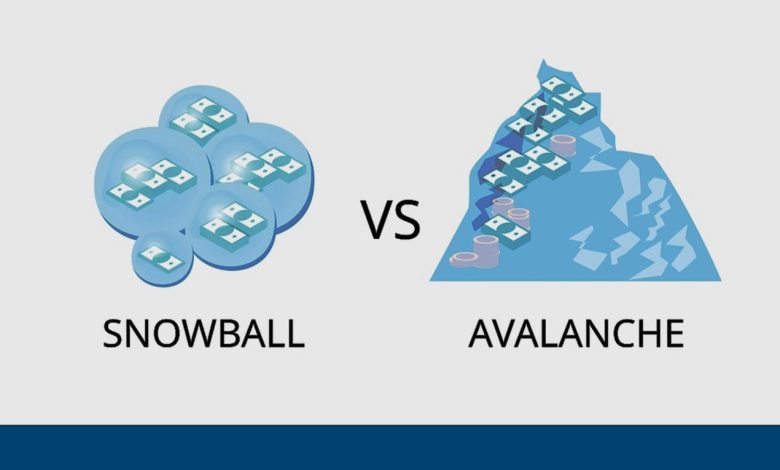

Steps to Resolve Debt: Choose Between Avalanche and Snowball Methods

Debt burden is the most troubling part of a person’s life as it creates an obligation for a person to make a standard monthly payment to pay the interest. However, paying the monthly EMIs or the debt is something that can go on for a long duration, creating trouble for the borrower if they face a certain cash crunch.

Emergencies can occur to a person at any time, and for that, one must stay prepared. One way of doing that is through the use of the right debt financing method, which can solve the problem of paying off debt for a long period and also reduce the burden of it quickly.

With the help of a DSA Partner, one can choose between the debt avalanche or snowball method to solve the debt issues faster. In this blog, we will discuss both the avalanche and the snowball methods for resolving the debt issue and also how these methods can help a person to increase their financial stability.

Understanding the Debt Avalanche Method

In the debt avalanche method, the main goal is to focus on paying that loan faster, which has the maximum interest rate. By prioritizing the payment on that loan, one can save from the overall payments that one needs to make towards the interest payment.

The avalanche method involves listing all your debts, from the highest to the lowest interest rate. Then, you need to make the minimum interest payments on all the other forms of loans and pay the extra cash you save each month on the loan account with the highest interest.

It will reduce the total interest one might have paid at the end of the loan period by paying towards the principal of that amount, thus allowing the borrower to close that high-interest loan early without shelling that extra amount that can be used towards savings. In this method, one can bring extra financial stability by taking the same approach on the next debt, thus reducing the burden further.

Who Can Choose This Method?

The best case for using an avalanche method is for someone who already has a loan of high interest. For example, a person who is down on credit card debt needs to follow through the process of an avalanche as that can significantly reduce the interest that’s there on the credit card and save a person tens and thousands of rupees.

Understanding the Debt Snowball Method

The snowball method is more about building the motivation and the momentum to build a habit of paying the debt. In this approach, the target is entirely different, where one will repay the smallest debt first. In this method, one needs to arrange the debt based on the principal amount and then stack it from the smallest to the largest.

The extra savings one used to make each month must go towards the smallest debt, and through that, one can write off a single loan entirely. We are human beings, and to us, a streak or momentum is important to stay on track. Once the smallest debt gets resolved, then the same approach continues to the next small payment, which helps a person to build momentum.

While starting the snowball method, one can take a loan financing option that will solve the issue of paying the smaller loans, and thus, the extra payment can go towards the large amount only.

A loan agency can guide a borrower in that this method takes the best of two worlds, and one can follow the snowball method by attaining the results of saving on interest that happens in the avalanche method.

Who Can Choose This Method?

In the snowball method, one can choose the format when a person doesn’t have a high interest rate on any loans but has multiple smaller loans. To pay off these micro-loans, one can start the snowball method, as it allows a person to have the little wins over some time and also to have the benefit of paying the debt and becoming financially free in the process.

These are the best two methods available, and one can choose one to quickly pay off the debt and become financially free in the meantime.